Our charges: buying and selling residential property

-

How much do we charge?

You can find full details of how we calculate our conveyancing charges below. For a quote specifically tailored to your case please just drop us an email info@landsmiths.co.uk and we can give you an exact quote.

Our charges are made up of:

a) our fees for the legal work;

b) ‘disbursements’ – disbursements are costs related to your matter that are payable to other people, such as Land Registry fees. We handle the payment of the disbursements on your behalf to ensure a smoother process; and

c) for property purchases, Stamp Duty Land Tax (see below).It would not normally be necessary to undertake other work or incur other costs other than those described above. However, we would be very happy to provide you with a more tailored quote for all stages of your particular case once we know about your specific circumstances.

-

Our fees

In the majority of cases we work on a fixed fee basis. Detailed information on the basis of our charges will be provided with your client care letter.

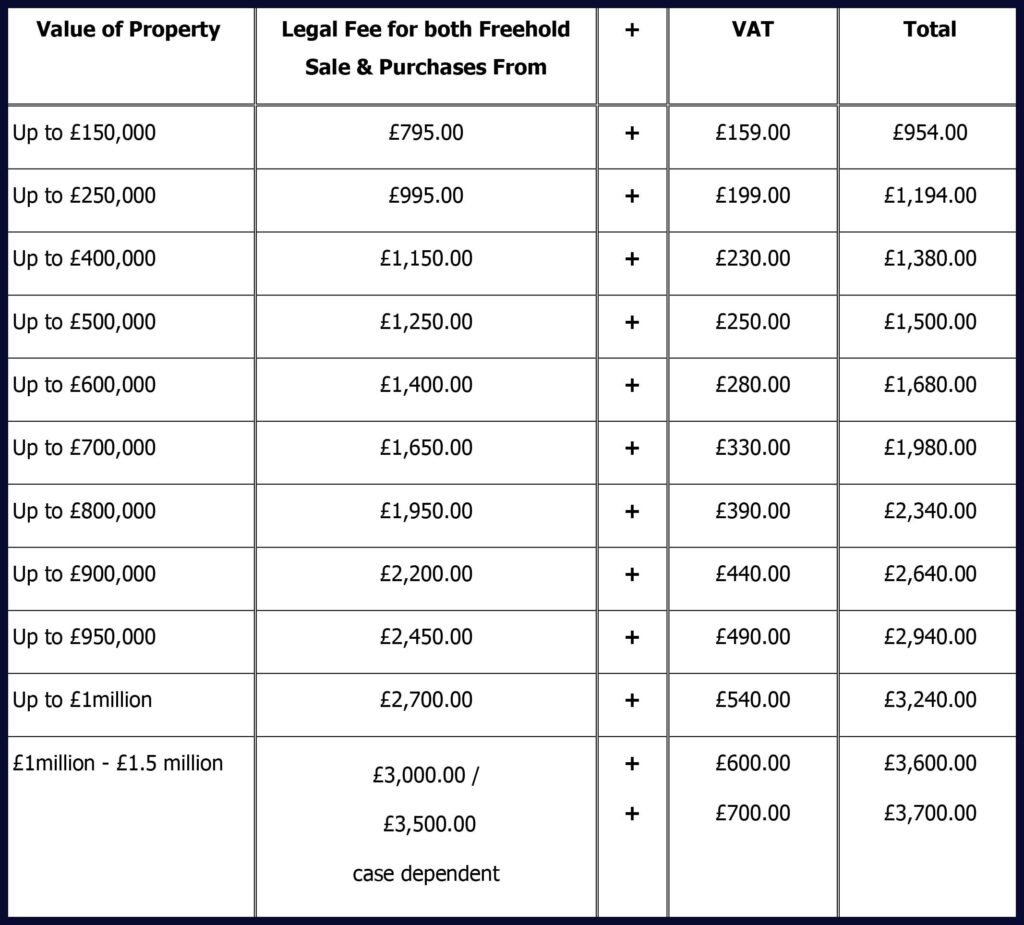

Our fees depend upon the value of the property you are buying or selling and are listed below:

Residential Fee Scale

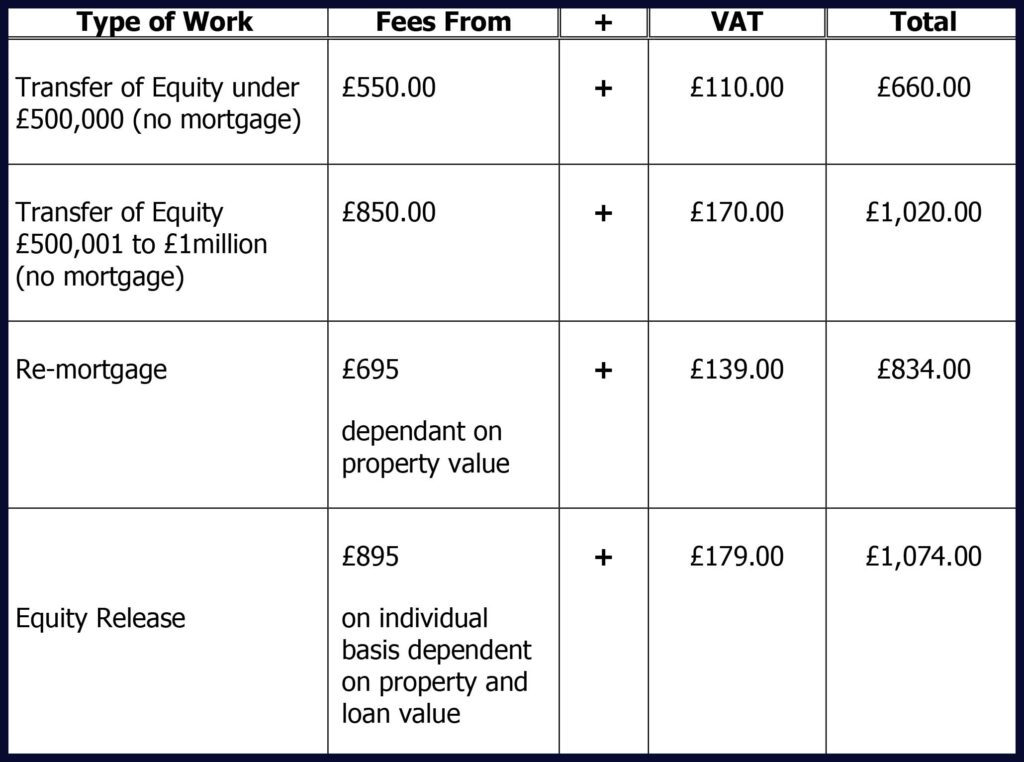

Different Aspects of Work

Extra Fees to Add

If you are buying and selling a property then a charge would be made for both the sale and the purchase. If you are re-mortgaging your property then we again charge a fixed fee dependent upon value.

If you are buying, selling or re-mortgaging a ‘leasehold’ property (rather than a ‘freehold’) then there is an additional charge of £200.00 excluding VAT.

If you are buying or selling a New Build property, a shared ownership property or using the Help to Buy scheme then there is also an additional charge of £200.00 excluding VAT.

Please note that VAT of 20% is also charged on all of our fees or legal work.

If, at any point during the transaction, money needs to be sent by telegraphic transfer, we charge a fee of £25.00 excluding VAT.

-

Disbursements

The ‘disbursements’ which you pay will depend upon whether you are buying or selling property or both, whether you are buying a freehold or leasehold property and the location and type of property concerned. Properties in certain locations for example need more searches and checks than others.

Please note that where VAT is applicable on ‘disbursements’ it is charged at 20%.

Normally all clients who are buying a ‘freehold’ property will need to pay the following disbursements:

• Search fees approximately £350-£500 including VAT dependent on the location of the property – please note Southern properties tend to be more expensive and may exceed this range.

• HM Land Registry fee £20 to £910 dependent on the type and value of the transaction.

• Land Charges Search £2 per name.

• Land Registry Search £3 per title number.

• Legal Anti Money Laundering searches £9.60 incl VAT per person.

• Legal Anti Money Laundering and Source of Funds check £12.00 incl VAT per person.When selling a property you will ordinarily need to pay the following disbursements:

• Land Registry Office Copy Entries and Title Plan £3 per document

If the property is a ‘leasehold’ property then the disbursements will be different and normally consist of:

• Notice of Transfer fee – This fee if chargeable is set out in the lease.

• Notice of Charge fee (if the property is to be mortgaged) – This fee is set out in the lease.

• Deed of Covenant fee – This fee is provided by the management company for the property and can be difficult to estimate.

• Certificate of Compliance fee – To be confirmed upon receipt of the lease.

• Leasehold Management Pack – This fee is chargeable when selling a leasehold property. -

Stamp Duty Land Tax

If you are buying a property you will also need to pay stamp duty land tax. You may also need to pay Stamp Duty when Transferring a property if you are retaining/obtaining a mortgage or money is changing hands. The amount which you need to pay to the government depends on the price of the property. You can calculate the amount you will need to pay by using HMRC’s website (or if the property is located in Wales by using the Welsh Revenue Authority’s website here.).

-

Other costs to consider

If you are purchasing a property we would always suggest you consider having a homebuyers survey, you would need to contact a surveyor directly and they would advise you of the costs for the same.

If you have a mortgage on the property, or have incurred an estate agent’s fee, we would also typically need to pay the money owed directly to your lender and agent as needed from the sale money we receive for you.

You should also be aware that if you are purchasing a leasehold property then ground rent and service charges are likely to apply throughout your ownership of the property. We will confirm the ground rent and the anticipated service charge as soon as this we receive this information.

-

Examples of our charges

The table below is a typical example of what charges we would make to the client selling a freehold property for £300,000.00:

- Our legal fees of £ incl. VAT

£1,140.00 - Telegraphic Transfer Fee £ incl VAT

£30.00 - Office Copy Entries

£9.00 - Legl AML Search Fee £ incl VAT (per name)

£9.60 TOTAL: £1188.60 Whereas the table below is a typical example of what charges we would make to a client buying a Freehold property for £350,000.00:

Our legal fees of £ incl VAT £1,140.00 Search fees of £ £450.00 approx Land charges search fee £ £4.80 Priority search fee £ £3.60 Land Registration fee £ £135.00 Legl Source of Funds & AML (per person) £12.00 Telegraphic Transfer Fee incl VAT £30.00 Total £1,775.40 SDLT is dependant on your personal circumstances, please use HMRC calculator

-

How long will my house sale / purchase take?

The average process takes between 8 and 12 weeks.

It can be quicker or slower, depending on the parties in the ‘chain’. Examples of factors that make a transaction more complex which can result in it being more time consuming include transaction reliant on probate, leasehold transactions, new build transactions or shared ownership transactions and finance with a lender who is not a typical high street mortgage lender.

In order to avoid any unnecessary delay please ensure all documents are returned and you place us in funds in a timely manner.

-

What legal work will you be doing for me?

The precise stages involved vary according to the circumstances. However typically in a property sale we need to do the following:

• Take your instructions and give you initial advice

• Receive and advise on sale contract documents where applicable

• Carry out searches on the property you are buying where appropriate

• Give you advice on all documents and information received

• Send final contract to you for signature

• Agree completion date (date from which you own the property)

• Exchange contracts and notify you that this has happened

• Complete the transactionIn a property purchase we need to do the following:

• Take your instructions and give you initial advice

• Check finances are in place to fund purchase where applicable and contact lender’s solicitors if needed

• Carry out searches on the property you are buying where appropriate

• Obtain further planning documentation if required

• Make any necessary enquiries of seller’s solicitor where applicable

• Give you advice on all documents and information received

• Go through conditions of mortgage offer with you

• Send final contract to you for signature

• Agree completion date (date from which you own the property)

• Exchange contracts and notify you that this has happened

• Arrange for all monies needed to be received from lender and you

• Complete purchase

• Deal with payment of Stamp Duty/Land Tax

• Deal with application for registration at Land RegistryIf we are simply helping you to remortgage your property then we would generally speaking only need to:

• Take your instructions and give you initial advice

• Carry out searches on the property you are buying where appropriate

• Obtain further planning documentation if required

• Go through conditions of mortgage offer with you.

• Send final documents to you for signature

• Apply for mortgage advance.

• Redeem any previous mortgages

• Deal with application for registration at the Land Registry.It would not normally be necessary to undertake other work or incur other costs other than those described above. However, we would be very happy to provide you with a more tailored quote for all stages of your particular case once we know about your specific circumstances.

-

Who will be dealing with my matter?

Your conveyancing transaction will be handled by a trusted member of our experienced conveyancing team. We have a number of qualified lawyers in the team as well as experienced paralegals specialised in this area of law. Once we know who will be handling your case for you we will introduce you to them and provide you with full details of their background and qualifications. Full details of the experience and qualifications of our team are available on our website https://landsmiths.co.uk/team/ including the types of work normally undertaken.

Regardless of who is working on your case the matter will be supervised by one of our Directors:

Michael Elvin

• Solicitor

• Over 30 years

• Commercial Property, Residential Property, Company & PlanningVik Moothia

• Solicitor

• Over 18 years

• Commercial Property, Residential Property & Company